Driving a Minivan on the Autobahn

(The following was a letter to clients featured in our end-of-year newsletter for 2023.)

As I reflect on 2023, so much comes to mind. This year has been full of surprises, but if we are honest with ourselves, what year hasn’t been? If I had to sum up 2023 in a simple analogy, it has been like driving a minivan on the Autobahn while en route to a family vacation in Europe. Bear with me, I’ll explain what I mean.

Imagine taking a vacation with your family to see the majestic beauty of Switzerland. Let’s say this represents your long-term financial goals. Unfortunately, your original flight was canceled due to bad weather and the only option was to book a flight to Munich, Germany. This may be equivalent to the broad market declines experienced by virtually every investor in 2022. As 2023 started, you may have felt a bit behind the intended schedule and not as close to your vacation destination as you may have liked but fortunately, you landed, all of your luggage made it, and you are now behind the wheel of a minivan driving on the historic German Autobahn. You chose this specific vehicle as it aligned with your needs and was most appropriate to help you reach your final destination. It is comfortable for the long drive ahead, roomy enough for everyone and all of the luggage, and is generally quite fuel efficient. It is also well-equipped to handle the bad weather that initially delayed the start of your vacation.

However, once you exit the city limits, there is famously no longer a speed limit on the Autobahn. A once comfortable 70 to 80 mph feels like a standstill as one after another, Mercedes, BMWs, and Porsches fly by you at 130+ mph.

Normally, you would feel cool, calm, and comfortable in your vehicle, yet as these flashes of German engineering whizz past you, a sense of envy and disdain might flood your soul. Suddenly the car that otherwise checked every box on your list of needs to deliver you to your destination feels mundane and pedestrian. It would be understandable if you started to feel envious of “everyone else” around you who seems to be able to enjoy the thrill of no speed limits. Also, you might normally be vigilant, or even hesitant, driving with inclement weather all around, but in this setting, it is easy to lose sight of these dangers. You may not even consider the implications of driving at 130 mph in bad weather on roads foreign to you. It would be so easy to instead fixate on the smile that would stretch from ear to ear if you were mashing the pedal into the floorboard of a brand new BMW M3, Porsche GT3, or Mercedes SLS AMG.

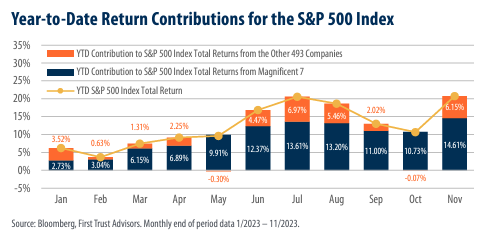

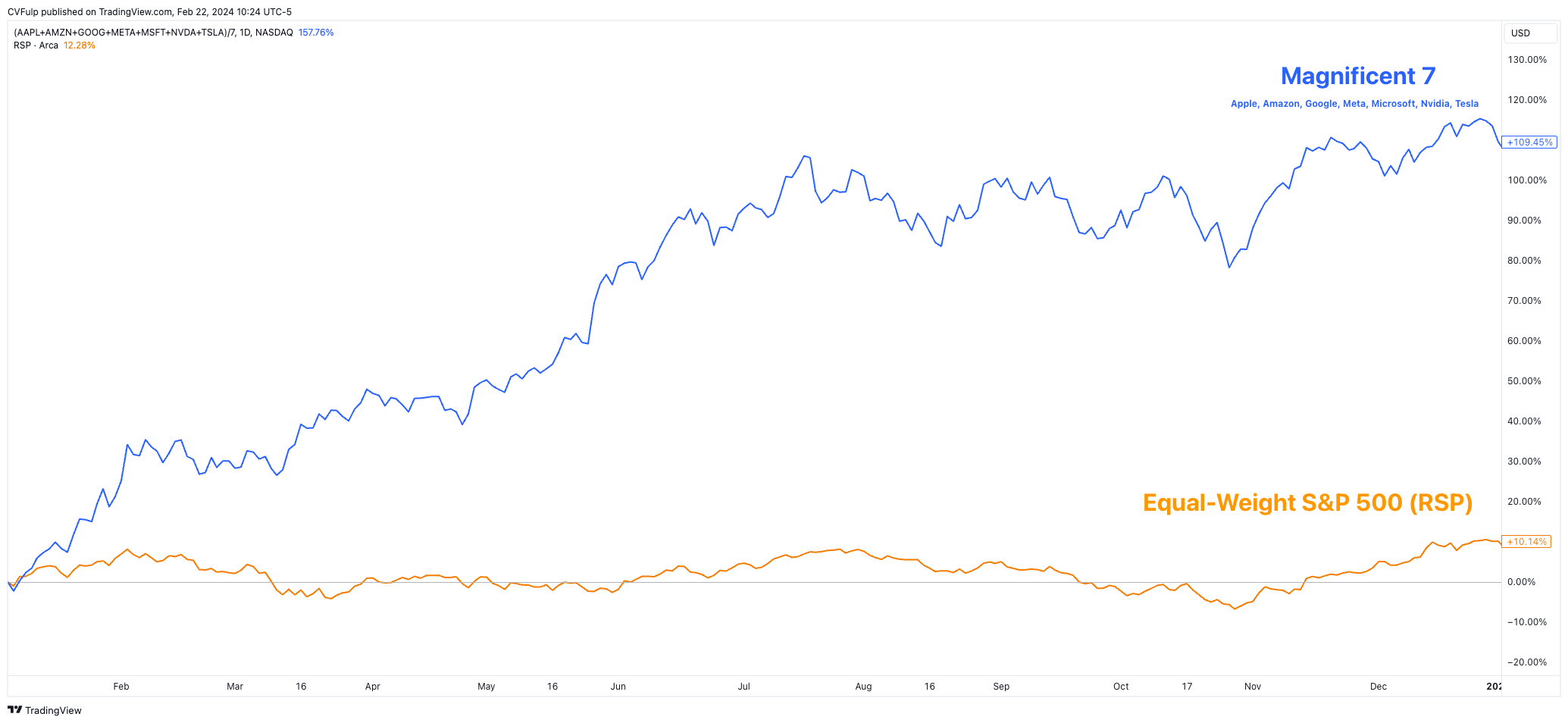

By now you have likely guessed that in this analogy, the minivan is your financial plan and investment portfolio. The investment market turmoil of 2022 is akin to the flight delays, hindering you from reaching your destination as quickly as you may have hoped. Inflationary pressures, Federal Reserve monetary policy, a looming recession risk, and geopolitical instability are akin to the bad weather all around. And those cars racing past you? Those cars are the S&P 500 and Nasdaq 100 indexes. More specifically, those cars are what have been dubbed the “Magnificent 7 stocks”, or “Mag7” for short. In reality, there are hundreds of other cars plodding down the road at your same pace, but they are easy to miss with these brightly colored, high-performance land missiles fly past you at the blink of an eye. As of this writing, the Mag 7 stocks are collectively up a mind-bending 115% for the year while the equally weighted S&P 500 is only up 12% for the year. The final quarter of the year has seen the broader stock market pick up, and your portfolio has participated to a high degree in this up move, but prior to November the true “stock market” was hardly attractive. It was these 7 stocks alone doing most, if not all of the legwork.

I know this year has been challenging. Last year was rough, but it was rough for virtually everyone. This year has been tougher to endure as the headline indexes seem to have just gone up. In the context of this vacation analogy, I do not blame anyone for feeling a bit of resentment towards your minivan as those high-performance cars fly past you. However, before getting too hung up on what the kids these days are calling “FOMO”, consider the following two questions:

1. **Have your needs changed?**

Much like choosing to rent the minivan for its reliability, economy, and suitability for long distances, your financial plan was crafted with specific objectives and your portfolio is managed in alignment with your overall comfort with and ability to take excess risk. Our investment discipline and process is time-tested, and designed for long-term investing. Despite the market turbulence and “bad weather”, have your fundamental needs for long-term financial success altered?

2. **Was the alternative appropriate at the time?**

Envy towards high-performance vehicles or headline-grabbing investments is natural, but when considering the past, reflect on the circumstances. Just as renting a high-performance car may be impractical for a family vacation, was concentrating solely on the S&P 500 or these “Mag 7” stocks the right choice amidst the uncertainties and risks prevalent at the beginning of 2023?

Recall that our objective is to achieve your long-term financial goals while also offsetting the deleterious effects of inflation and taxation. There have been and continue to be tremendous risks surrounding the investment environment AND there are also the persistent “unknown” threats that life may throw at each of us individually, which we can never fully anticipate or forecast. When we began our financial journey together, we assessed your tolerance for risk and volatility in your portfolio while also considering the goals that need to be met.

As we began 2023, the S&P 500 had just experienced a nearly 20% loss in the year before. We had a rare consensus view from surveyed economists that a recession was “imminent” in 2023. We had a continued war in Ukraine to which the United States was idiotically throwing dollar after dollar at. By just the end of the first quarter, the supposed “total banking collapse” or at a minimum a “regional banking collapse” was kicked off by the Silicon Valley Bank failure. Soon after we were hearing whispers of the Chinese Spy balloon that was sure to catalyze a war with China by way of the Taiwan conflict. All the while, we were still experiencing inflation rates in excess of 6-8%. Oh, and don’t forget about how ChatGPT was released (followed immediately by several other LLM artificial intelligence systems) all of which were sure to “completely unhinge labor markets and take all the jobs away”. Then there were the labor strikes from Hollywood to Detroit to railroad yards to coffee shops nationwide. Finally, just as the year began to wind down, we saw significant conflict in the Middle East once again erupted. And this was almost immediately followed by a surge in the 10 year treasury yield to 5%, which many news reports suggested spelled immediate disaster (I really do loathe the news media). I certainly don’t mean to trigger PTSD in anyone rehashing just a handful of the wild conditions we faced in 2023, it is important to remember all of the “bad weather” happening around us that presents a menagerie of risk which must be accounted for in order to be prudent, but successful, long term investors.

Then again, perhaps we should forget about all of the “bad weather” for a moment. You may be thinking, “There will always be a plethora of unknown factors and events,” and I agree, so instead let’s only consider the following: As of January 2023 the S&P 500 was trading at a Price to Earnings (P/E) ratio of 23, meaning the price of the S&P 500 was 23 times that of the collective earnings of the S&P 500 companies. To put that into context, even after suffering a 20% decline in 2022, the S&P 500 was still priced 44% more expensive than its historical average P/E of 16. Sure, markets can still outperform when priced at a steep premium to the historical average, but generally speaking, it’s not too crazy to suggest that most people would not rush to purchase anything that is 44% more expensive than it has been, on average, for more than one hundred years.

Ultimately, I know the past two years have been tough. However, I also know how important it is to put two years into the context of your bigger lifetime picture. Let's keep our eyes on the destination – your long-term financial goals. The road may be bumpy at times, but your investment plan is designed to weather uncertainties and deliver you to your destination securely.

So here’s to a prosperous, happy, and healthy New Year! I am looking very forward to continuing our journey together in the years ahead.